Earn 9%–15% on Senior Secured Bonds.

Lower risk. Fixed returns. Start investing on Aspero with just ₹10,000.

Explore Bonds

Tax planning to save income tax is a common struggle, especially if you fall into the highest tax slab. There are two ways to save taxes: claim deductible expenses under the Income Tax Act, such as medical expenses, home loans, donations, and tuition fees. In light of this, finding tax saving instruments to park your money in becomes critical.

Another preferred method, especially for individuals earning over ₹15,00,000 annual income is to invest in tax-saving instruments such as tax-saving fixed deposits and bonds. These instruments are usually low-risk and fixed-income investment options that help maintain a balanced portfolio. By investing them, you can reduce your taxable income and earn stable returns.

Let’s look at the popular tax-saving instruments, their features and benefits, exploring some of the best of tax saving investments and instruments available, including but not limited to tax-saving fixed deposits and bonds.

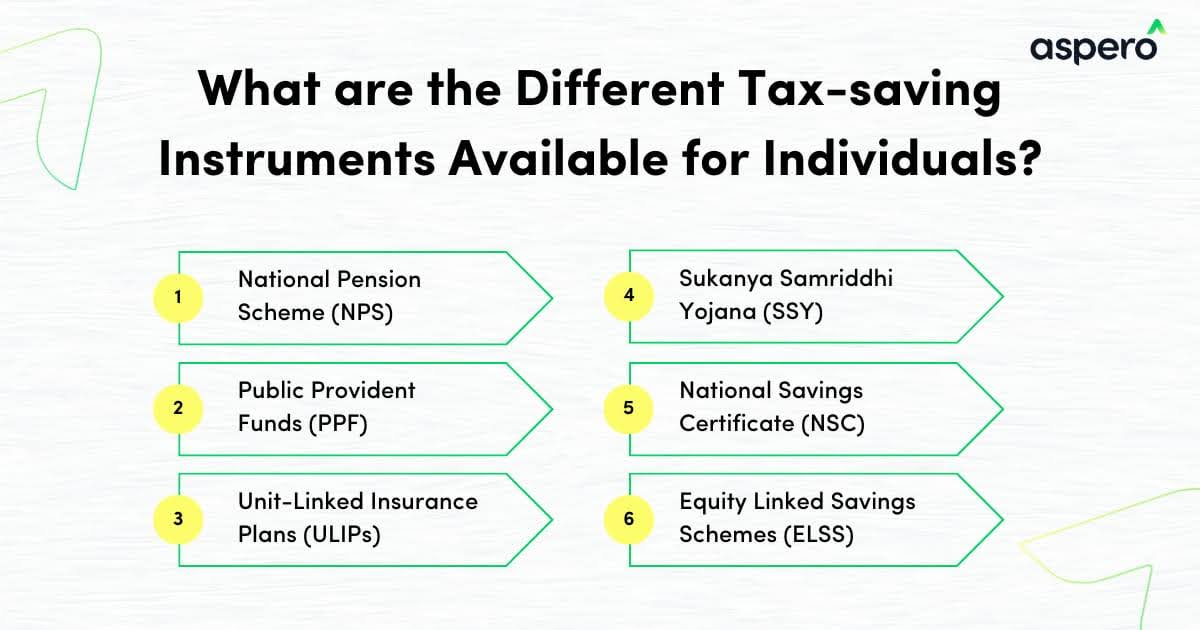

Common Tax-Saving Instruments

Section 80C of the Income Tax Act, 1961 is one of the most utilised sections for tax saving. Under it, you can claim deductions up to a maximum of ₹1,50,000 per financial year by investing in the following tax-saving instruments: This list includes a variety of instruments such as the equity linked saving scheme, senior citizen savings scheme, and unit linked life insurance policy and plan, each offering unique benefits and tax advantages.

1. National Pension Scheme (NPS)

The National Pension Scheme is a long-term investment scheme that provides investors with a stable pension after retirement. Under 80C, you can deduct NPS investments up to ₹1,50,000. An additional ₹50,000 deduction is also available under Section 80CCD (1B), making total NPS investment and deductions under section 80c go up to ₹2,00,000.

2. PPF

Public Provident Fund is a central government scheme that provides regular interest income on the contributions made to the PPF account opened in a bank or post office. Investors can withdraw the amount after a lock-in period of 15 years.

3. ULIPs

Unit-linked Insurance Plans (ULIPs) are investment-cum-insurance products that invest a certain portion of the contribution towards life insurance and premiums and the remaining in debt and equity funds.

4. Sukanya Samridhi Yojana

Sukanya Samriddhi Yojana (SSY) is a government-backed savings scheme in India for the financial security of the girl child. The interest is compounded annually and invested into the SSY account.

5. National Savings Certificate

National Saving Certificate is a fixed-income investment scheme for small and mid-income investors. Upon maturity, the investor receives the principal amount along with accrued interest.

6. Equity Linked Savings Scheme

ELSS is a mutual fund scheme primarily investing in equities and equity-related instruments. ELSS funds have a mandatory lock-in period of three years, the shortest among all tax-saving investment options under Section 80C.

Fixed-Income Tax-Saving Instruments

Your asset allocation strategy must have a safety net to balance the high volatility of equity investments. Fixed-income instruments such as tax-saving fixed deposits and tax-saving bonds can provide a safety net by ensuring a stable income and reduced tax liability.

FDs as Tax-Saving Instruments

Tax-saving FDs are fixed deposits that allow investors to claim tax deductions on the principal amount. Interest varies between 7% to 9% for different banks. The maximum investment limit for tax-saving FDs in a financial year is ₹1.5 lakh.

Taxation

As per Section 80C, you can deduct the principal amount of tax-saving FDs from your taxable income, up to a maximum limit of ₹1,50,000 per financial year.

Lock-in Period

Tax-saving FDs have a lock-in period of 5 years with no premature withdrawal facility. They do not offer overdraft or loan facilities.

Tax on Interest

The interest earned on tax-saving FDs is taxable as per your income tax slab. You need to pay the tax in the year of accrual, even if the interest is not withdrawn and reinvested. Furthermore, 10% TDS is applicable if the interest earned on FDs for a financial year exceeds ₹40,000. If you haven’t deposited PAN details to the bank, 20% TDS is applicable.

FD Accounts

Only resident individuals and Hindu Undivided Families can invest in a tax-saving FD through a single account or open a joint FD account. In the case of a joint FD account, only the first holder can avail tax deduction.

Insurance

If a bank fails to pay interest or repay the principal amount at maturity, you are eligible for ₹5,00,000 in insurance provided by the Deposit Insurance and Credit Guarantee Corporation (DICGC).

Before choosing a tax-saving FD, compare interest rates of different banks or financial institutions. Furthermore, as tax-saving FDs have low liquidity because of the lock-in period, ensure you have sufficient funds to meet unforeseen financial requirements.

Bonds as Tax-Saving Instruments

Bonds are debt instruments issued by governments, corporations, municipalities or other entities to raise capital. They offer the investors a fixed rate of return (yield) on maturity. Although there are numerous types of bonds, two provide tax benefits—tax-saving and tax-free bonds.

Tax-Saving Bonds

These bonds provide regular interest on the invested amount. You can claim a deduction of up to ₹20,000 on the invested amount in tax-saving bonds under section 80CCF on the invested amount, along with the Rs 1,50,000 deduction under section 80C.

Key Features

The minimum investment amount for tax-saving bonds is ₹1,000 and they come with a lock-in period of 5 years. The interest rate varies from 6%-8% per annum.

Eligibility Criteria

Indian citizens, Hindu Undivided Families (HUFs), and charitable organisations under the Indian Companies Act 1956 can invest in tax-saving bonds.

Application Process

You can apply for tax-saving bonds by filling in their application form or applying at the time when their issue is live.

Types of Tax-Savings Bonds

- Zero-Coupon Bonds

These bonds do not provide any interest but are offered at a discount. Investors get the face value of the bonds on maturity.

- s (s)

These bonds are issued by the RBI and are denominated in grams of gold. On maturity, you can redeem these bonds in cash as per the ongoing market price. You can invest in a minimum of one gram and maximum of 4 kgs of gold as s.

- Fixed-Rate Bonds

Such bonds have a fixed interest or coupon rate and provide fixed interest payments or coupon payments half-yearly or annual until maturity.

- Floating Rate Bonds

These bonds have a variable interest rate, which is revised quarterly, half-yearly, or yearly as per certain benchmarks such as repo or reverse repo rates.

Tax-Free Bonds

Tax-free bonds are financial instuments issued by government enterprises and offer regular and fixed interest payment rates to the bondholders. The interest earned on tax-free bonds comes under tax-exemption under Section 10 of the Income Tax Act. TDS is also not applicable to these bonds.

Key Features

These bonds have a higher lock-in period, between 10 to 20 years. The interest ranges from 5.50% to 6.50% with no premature withdrawal option. However, you can sell them in the secondary market. These bonds are either issued physically or online through the demat account.

Eligibility Criteria

Indian citizens, Hindu Undivided Families (HUFs), and charitable organisations under the Indian Companies Act 1956 can invest in tax-free bonds.

Application Process

You can apply to both online and offline tax-free bonds while their subscription is open. To do so, you must fill out a form and submit your PAN and KYC details.

Types of Tax-Free Bonds

Some popular tax-free bonds are housing, infrastructure, railway, power, and PSU bonds.

FDs vs. Bonds: Which is the Better Tax-Saving Instrument?

Fixed Deposits (FDs) and bonds are popular investment and tax-saving options. Here are some comparison factors for FD vs. bonds so that you can invest wisely:

- Risk

FDs are considered the safest fixed-income instruments, while bond risk can vary depending on the issuer and type of bond. If you want to have lower risk, you can invest in tax-saving FDs and fixed-rate government bonds.

Liquidity

Tax-saving FDs have low liquidity because there is a minimum lock-in period of five years. However, bonds can be sold in the secondary market.

TDS

For tax-saving FDs, 10% TDS is applicable if the interest earned in a financial year exceeds Rs. 40,000. However, to avoid TDS, you can buy tax-free bonds.

Returns

Bonds may offer higher returns compared to FDs but have associated credit risks.

Align Investments with Your Financial Goals

Choosing tax-saving instruments that not only align with your financial goals but also offer significant tax benefits and opportunities to save tax is essential. Bonds and fixed deposits are the most popular fixed and tax-saving investment options, as they offer high returns. However, their benefits and risks differ.

Therefore, it is crucial to align investments in tax-saving instruments with your financial goals and risk tolerance. Consider consulting with a tax or finance expert to make informed decisions.

You can also explore Aspero Fixed Income Academy for more information about fixed-income investments.