What is a Deep-Discount Bond?

It is a classification of those bonds sold at a discounted price than their par value. These discount bonds are sold at a rebate of 20% or more to par. Not to mention, these bonds have a higher yield than the prevailing fixed-income securities rate with an identical profile.

Such junk bonds have poor market prices. It is because of the fundamental concern about the inability of the issuers to repay the principal or interest on the debt.

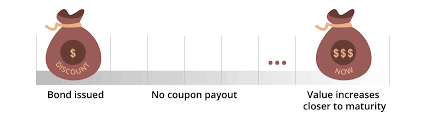

However, it is not the same in every scenario. Zero-coupon bonds often start trading at a discounted price even if the issuer’s credit quality is higher.

Note: Deep-discount bonds also comprise zero coupon bonds. These bonds do not pay interest rates to the holder.

Example and Calculation of Deep-Discount Bonds

Here is an instance of a discount bond.

Assume that on NASDAQ, a bond is listed that is presently trading at a discount. The coupon rate for the bond is 4.92. The cost at the time of bond issuance is USD 100. The yield is 4.92%. The current price is USD 79.943. This show that the particular bond is trading at a discount.

Even though the coupon rate is higher than the yield on a given 10-year Treasury note, the Bond prices are still discounted. It is because the earnings of the company are lower. It boosts the default risk.

The yield can also trade higher than a coupon rate. It takes place when the face value is greater than the price. It clearly states that it is a discounted bond. Likewise, when a company’s credit rating suffers due to a credit agency, investors begin selling in high volumes in the secondary market.

Here is how you can calculate deep-discounted bonds:

P= F(1+r) ^h.

As per this formula:

P= Price of bond

r- Implied discount rate

H – Holding period

F – Face value

Conclusion

Certain risks must be evaluated and considered before investing in a deep-discount bond. These risks include Credit Risk, Reinvestment Risk, Interest Rate Risk, Liquidity Risk, Inflation Risk, etc.

With such bonds, investors can lock in an increased rate of return for a sustainable amount of time. Not to mention, investors can also leverage the benefits tagged with such investments.