What is a Convertible Bond?

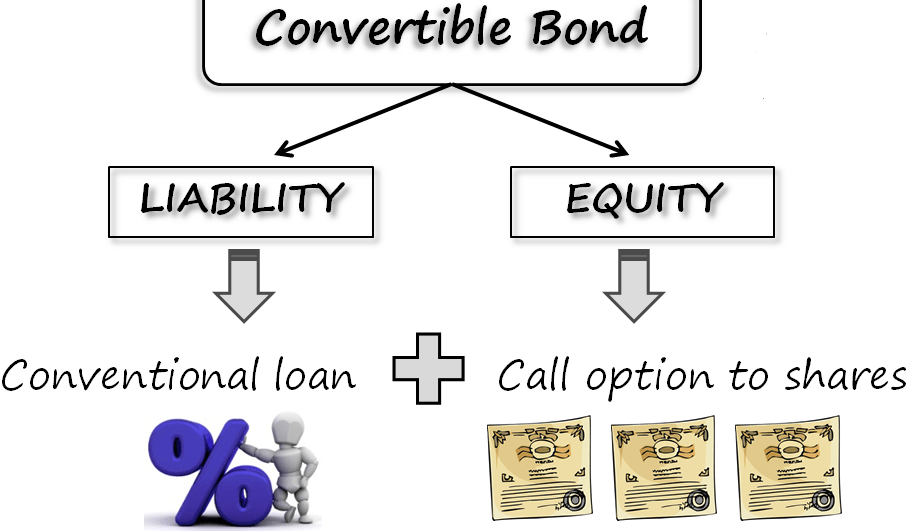

Convertible bonds are fixed-income debt security instruments that convert to securities issued by businesses to raise capital under financial duress. These bonds exhibit hybrid security characteristics, offering regular interest payments and allowing investors to convert the bond into company equity shares & sizeable conversion premiums.

Companies with sub-par credit ratings but good growth potential issue convertible bonds to gain necessary capital funding while offering lower yields to investors. Compared to regular corporate bonds, the interest payments of these bonds are much lower than traditional fixed income instruments. Still, the option to convert when the underlying stock price rises make them attractive to investors.

The coupon payments of convertible bonds are comparatively lower than common stocks. The conversion option is a sweetener for investors, which is why the better the price of the issuing company’s stock, the lower the bond yield.

Quite a few different types of convertible bonds are available on the stock market.

Features of Convertible Bonds

A convertible bond exhibits all the features of regular corporate bonds but offers the dual benefits of a fixed income debt and an equity instrument.

1. Coupon Payment:

Convertible bonds offer a specific coupon rate to their lenders/investors. This is interest paid to the investors over the par or face value of the bond. The coupon rate or rate of interest of a convertible bond is lower due to the conversion option, thereby enabling the issuing company to acquire scarce capital at lower costs.

2. Conversion Ratio

The option to convert attracts most convertible bond investors to lend their money. The conversion ratio is the company’s number of shares in exchange for a single convertible. For example, if you receive 20 equity shares after exercising the convert option, then 20 is the conversion ratio of your bond.

3. Conversion Price

Conversion prices are what you get when you divide the face value of the convertible by its number of shares. So, suppose the par or face value of the bond is Rs. 1000, and its conversion ratio is 20. In that case, the conversion price is Rs. 50. For a vanilla convertible bond, the norm is to convert bonds into stocks once the market price of the equity shares increases substantially above the conversion price.

Why Do Companies Issue Convertible Bonds?

Companies issue convertible bonds when they are under financial strain and need some vital boost to their capital reserves. Convertible bonds help companies acquire essential capital funding at low costs. The lower coupon rate of a convertible bond, compared to regular corporate bonds, allows a business to obtain debt funding at lower interest expenses. Moreover, unlike common stock, a convertible bond is tax deductible.

Delay in stock dilution is another primary reason behind issuing convertible bonds. A company comfortable with stock dilution but not in the near future can choose convertible debt financing over equity financing. This is generally the case for businesses with immense growth potential, who are confident of a rise in the value of equity shares in the long term and a higher net income.

Startups are significant issuers of convertible bonds. They issue bonds, especially when contending with projects that may strain their current finances but are sure to rake in the money in the future. In addition, the potential for growth and rise in the value of equity shares attract investors, who can benefit from the appreciating capital in the future.

Conversion Ratio of Convertible Bonds

The conversion ratio of convertible bonds is the number of equity shares associated with a singular bond. You can determine the conversion ratio by dividing the bond’s par or face value by the underlying stock’s conversion price. So, if the share price is Rs. 50, and the linked convertible bond’s face value is Rs. 5000, then the conversion ratio is 100 to 1; that is, 1 bond can be converted into 100 shares of Rs. 50 each.

Convertible bonds are ideal investment vehicles for investors with low-risk tolerance. This is because of the additional security that bonds offer and the fact that bondholders are priority receivers of the proceeds in case of company liquidation.

A bond is termed convertible if it comes with the option to be converted into a set number of equity shares as determined by its conversion ratio. The bondholder can choose to exercise the conversion option at his whims or it may be forced upon him at the discretion of the issuing company; it all depends on the type of convertible bond being invested in.

With the security & fixed interest payout of corporate bonds and the assurance of stock returns, convertible bonds are an excellent investment choice for risk-averse investors.

Investors stand to lose money if the issuing company defaults on interest & principal payments. Also, if there is a drastic fall in the stock prices, investors have to forfeit the promise of stock returns associated with the convertible security.