Earn 9%–15% on Senior Secured Bonds.

Lower risk. Fixed returns. Start investing on Aspero with just ₹10,000.

Explore Bonds

Investing in bonds

Bonds are a popular investment vehicle for those seeking steady income and stability and also for those looking to diversify their otherwise aggressive investment portfolio by building in a safety cushion to meet their financial goals. Unlike equity and other risky instruments, bonds offer relatively predictable returns.

In essence, a bond is a loan made to an issuer by an investor. The issuer is usually a company or government entity that needs to raise capital for a project, expansion, or other expenses. The bond represents a promise to repay the loan with interest over a specific time frame. If you’re new to bond investing, there are several factors to consider to ensure that you make informed decisions and maximize your returns.

Here are the top five things to know before you start investing in bonds:

Understanding the basics of bonds

Bonds are debt securities issued by companies or governments to raise capital. They typically have a fixed interest rate and a maturity date, which is the date the bondholder will receive the principal amount, similar to FDs. The issuer pays interest to the bondholder at regular intervals until maturity. When the bond matures, the issuer repays the principal to the bondholder. Bond prices and interest rates are inversely related, meaning when interest rates rise, bond prices fall, and vice versa. Understanding these basics is crucial when investing in bonds.

Assessing the creditworthiness of the issuer

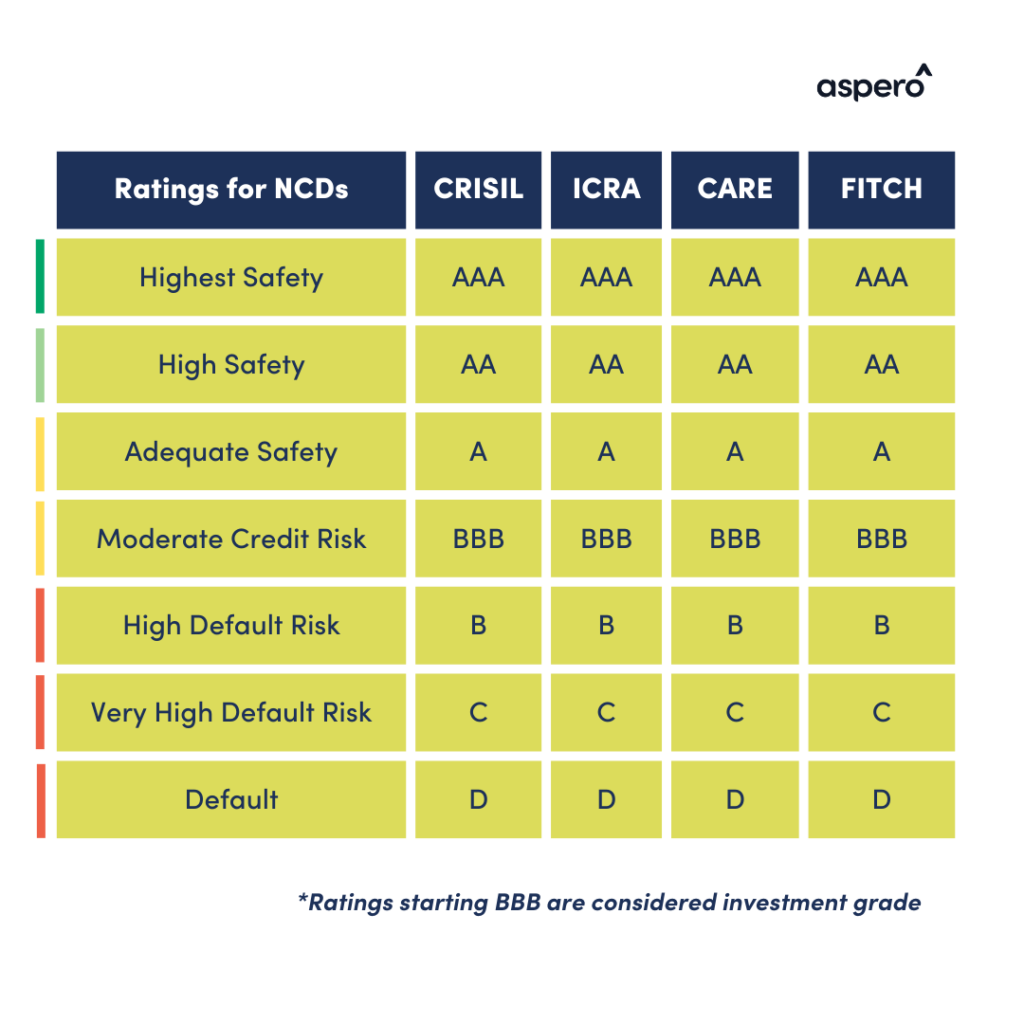

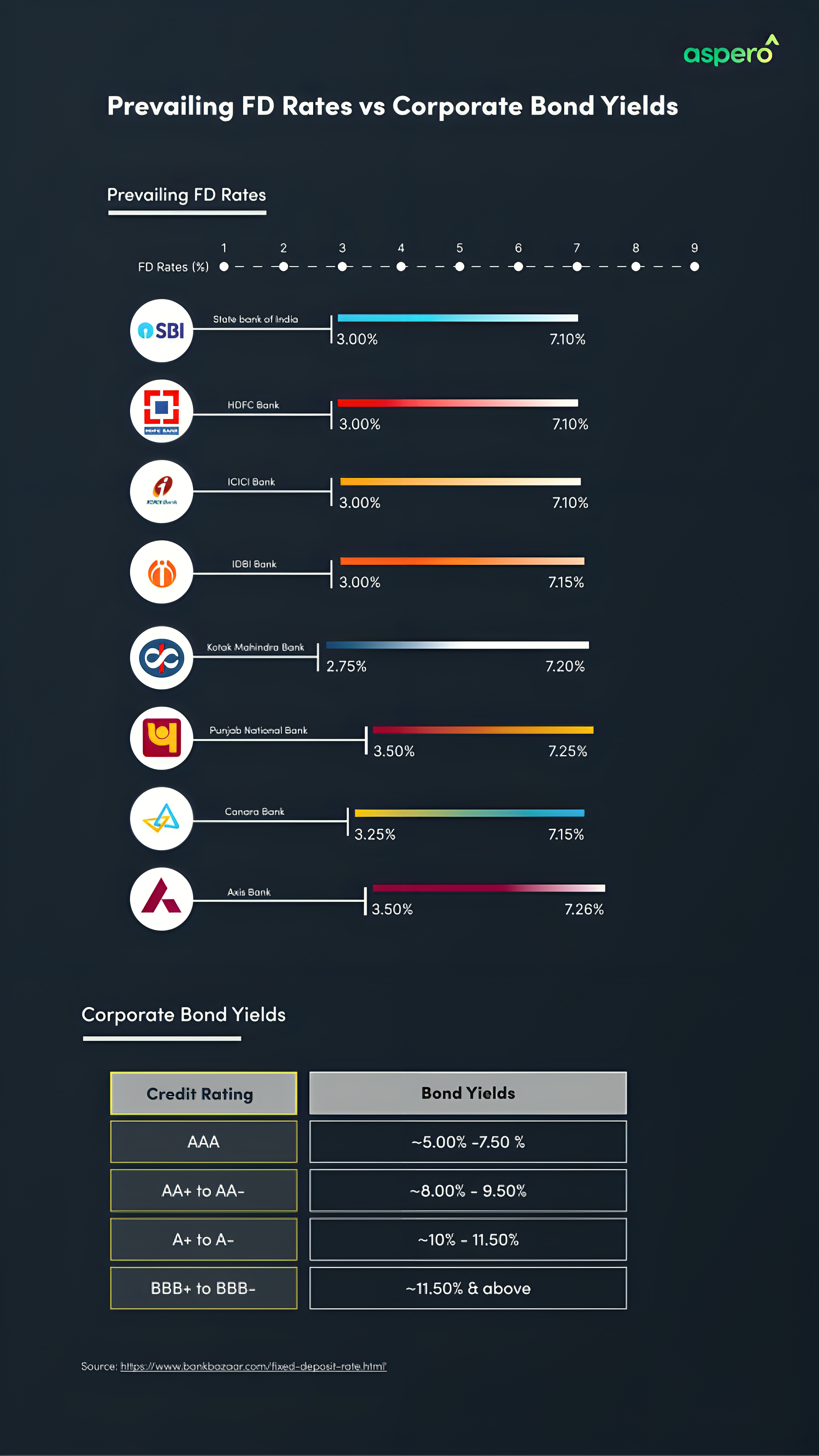

The creditworthiness of the issuer is a crucial factor to consider when investing in bonds. It refers to the ability of the issuer to repay the principal and interest on the bond. Credit ratings agencies such as ICRA, CRISIL etc. rate bonds based on the issuer’s financial strength and ability to repay the bond. Investment grade ratings typically range from AAA+ to BBB-; the higher the investment grade, the safer the asset to invest in. Investors with a low risk appetite should avoid investing in bonds issued by companies or governments with low credit ratings.

Identifying the type of bond that suits your investment needs

There are several types of bonds available, including government bonds, municipal bonds, corporate bonds, and high-yield bonds. Bonds can be segmented into various categories based on interest payment, security, tenor, equity characteristics etc. Aside from the credit rating of the issuer, the security of the bond is another key consideration to help you determine the degree of safety of your investment. Bonds backed by a collateral as a security are referred to as secured bonds, and those without any backup collateral are referred to as unsecured bonds, with the latter being riskier than the former.

The most commonly traded corporate bonds in India are NCDs or Non-convertible debentures. Non-convertible debentures are fixed-income securities that offer a predetermined rate of return and cannot be converted into equity shares unlike Convertible debentures where the instrument can be converted into an equity share on the occurrence of a specific trigger event or a predetermined timeline. You can learn more about different types of bonds here.

Understanding the bond’s yield and duration

The yield and duration of a bond are critical factors to consider when investing. Yield refers to the return on the investment and is usually expressed as a percentage. Duration refers to the length of time until the bond matures. Longer-duration bonds usually offer higher returns due to the interest compounding, while shorter-duration bonds typically offer lower returns, but are great in case you’re looking for higher liquidity. Understanding the yield and duration of the bond will help you make informed investment decisions.

Diversifying your bond portfolio

Diversification is crucial when investing in bonds. Investing in a variety of bonds reduces the overall risk of the portfolio. A diversified bond portfolio should include bonds with different maturities, credit ratings, and issuers. This will ensure that if one bond defaults, the entire portfolio will not be affected.

In conclusion, investing in bonds can provide a steady source of income and stability. However, before investing, it is crucial to understand the basics of bonds, assess the creditworthiness of the issuer, identify the type of bond that suits your investment needs, understand the bond’s yield and duration, and diversify your bond portfolio. By considering these factors, investors can make informed decisions and maximize their returns.